- The Wealth Span

- Posts

- THE FRAMEWORK FOR FINANCIAL GOALS

THE FRAMEWORK FOR FINANCIAL GOALS

An 8 Step Guide to Create Goals Aligned with Your Future

Welcome to The Wealth Span - if you want to join the growing list of business owners, entrepreneurs, and investors learning about investing and building wealth each week, subscribe below...

Feel free to read the most popular posts and connect with me on LinkedIn!

Now - today's post...

___________________________________

There are many different targets in our financial lives. The list of things you could do is miles long. Saving/investing for retirement, investing in a piece of real estate or business, buying a new car, saving for a house or a vacation — you might even want to relax and enjoy life more.

Several items on the list are probably sliding into your personal to-do list in the early months of the new year. When the possibilities are endless, it is difficult to determine/prioritize what items or goals should actually make their way into your life.

Nearly every financial goal is a worthy use of time. But what should be first on the agenda? How do you identify the most efficient path? And most importantly, what will actually bring more meaning/purpose to life?

This post should help you find an answer to these questions. A framework for setting financial goals puts you in an optimal position, in both your financial life and beyond.

___________________________________

FIND THE DATA

It helps to think of your personal finances just like a business.

A good business has great cash flow. There is more money coming in than going out. The equity in a business is determined by whatever assets and liabilities are on the balance sheet.

Your personal finances are the same components. Your cash flow situation is a quick summary of what you earn, invest, and spend. Your net worth statement is a summary of what you own and owe. This allows you to get an accurate, objective view of your financial past, present and future.

Getting accurate data provides the opportunity to take a clear, honest look at your current financial situation.

Your banking app may provide an estimate of your monthly cash flow. There are other secondary apps or websites that will link to your checking/saving accounts to create an estimate as well. With a few changes, you can probably have a mostly solid, back-of-the-napkin picture of what comes in and goes out each month.

This work is the basis of a cash flow statement. Next, you’ll need a net worth statement. For now, the goal is simply to list both your assets and liabilities.

1/ Your assets (what you own).2/ Your liabilities (what you owe).

With these two components in hand, you will have a good handle on the actual data of your financial life.

UNDERSTAND YOUR WANTS/NEEDS

When it comes to financial goals, you can do just about anything. You won’t be able to do everything all at once though. You must be able to determine what goal will be most rewarding to you.

So, what’s most important to you? What will be most rewarding, impactful, or meaningful?

Is it getting out of debt? Setting aside extra dollars for an emergency fund? Increasing the dollars you invest? Saving for a house? Traveling?

You cannot create goals based on what other people want or need. Your goals should be focused on your wants and needs. When you understand what items are most important, you are able to create goals and intentionally design your financial life.

GO BEYOND THE NUMBERS

Your financial life can quickly become minutiae. The cash flow and net worth statements are full of numerical values. You have a savings rate and your investments earn a rate of return. The numbers and percentages are nearly endless.

Instead of focusing on the tiny, spreadsheet-level details, you can look beyond. First, what do you want your life to look like broadly? Then, how can you align your financial life with this outcome?

You can use the numbers as a guidepost. The values and percentages will provide useful information, but you shouldn’t obsess or worry about them. A number shouldn’t dictate every aspect of your life.

It’s important to identify what you want and need from a financial perspective. We attempted to do this a moment ago. Now, you must go beyond the numbers.

Set your overall goals for life first, then backcast to determine your financial goals. With your desired end result in mind, what should you change about your financial life?

CHOOSE OBJECTIVES FOR THE LIFE YOU REALLY WANT

Some of these questions are difficult to answer. Many times, it is easy to see an issue with your finances, but it is significantly more difficult to align your financial goals with the broader picture of your life.

In order to do this, understanding your priorities is key. This will empower you to make choices and set goals that actually reflect your priorities.

Of course, some priorities will be nearly universal. Paying off high interest debt should be a priority. Building wealth through investing should be a priority. These goals may look different on the margins for every person, but generally speaking, everyone will have comparable basic priorities.

That being said, your priorities need to be your own. The details of your life come into play. You financial life and circumstances are unique to you.

For example, you shouldn’t buy a house just because everyone says it’s the right thing to do. Instead, do it because it reflects your priorities (e.g., you want a backyard with a hot tub and a fire pit).

Don’t be an aggressive saver/investor just because it seems cool. Do it because it aligns with your unique priorities (e.g., you want to retire early or bless others through your wealth).

At the same time, don’t set out to accomplish a goal if it doesn’t align with your priorities.

REFINE YOUR PRIORITIES

Building a list of your priorities is an important step in creating your financial plan.

There is little need for a formal process. Deep down, you probably understand what your priorities are already, you may just have to do a little digging.

Try to determine your top, overall priority as well as your top three priorities generally. Going beyond a few priorities will muddy the water. Try to stay focused and intentional.

Examples of financial priorities/values might include:

Enjoy experiences with people you love.

Develop/grow as an individual.

Achieve your true potential.

Raise a family in a stable environment.

Find freedom and independence.

Reset the trajectory of your children and grandchildren.

SET ONE-YEAR TARGETS

With your priorities set, now list a few things you’d like to accomplish financially throughout the next year.

Remember, each goal should tie out to your priorities!

Examples include:

Create/expand an emergency fund.

Schedule and save dollars for a dream vacation.

Increase your contribution to a Roth IRA to max it out.

Open a SEP IRA to optimize your business income.

Attend a professional conference.

Establish an estate plan.

Some goals can naturally be accomplished over the course of a year. Attaching a timeline to your goals/targets is an essential part of the framework.

When you accomplish any goal in a year’s time, you create some serious momentum for the future.

A LONG-TERM VIEW

Your financial life is a series of one-year increments. If you accomplish several of your goals in the next year but don’t carry forward the momentum/progress into every successive year - you’ll be in trouble.

The process you use to achieve goals over a decade’s time or more will be the key to your success. Building wealth is a long-term activity. It is fundamental to nearly every component of investing/financial planning, even life broadly.

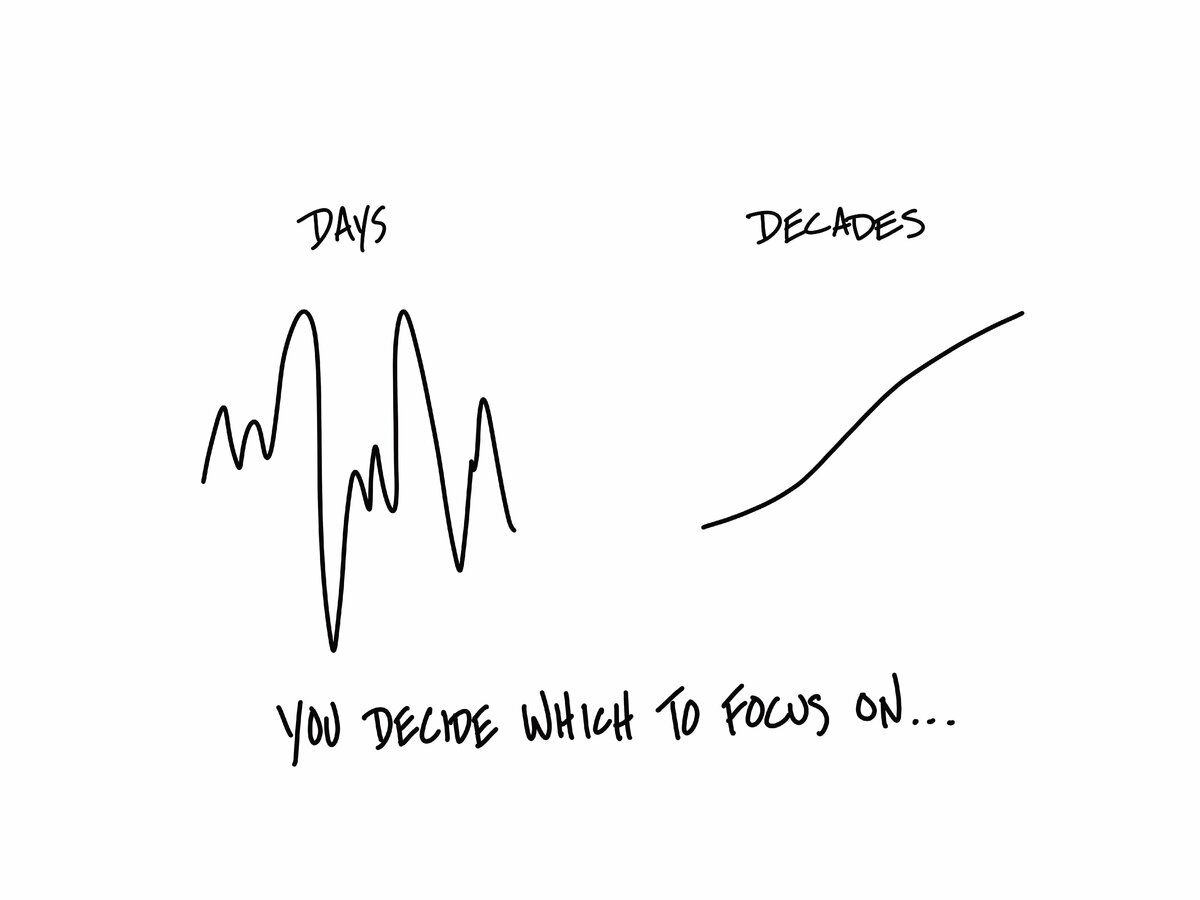

The days and even years will have some exciting or sometimes scary swings. When you feel yourself being consumed by short-term events or outcomes, remember to zoom out.

A decade’s worth of results and wealth will be determined by your habits, effort, and focus.

This depiction from Carl Richards is a great summary of what building wealth and long-term success look like in real life.

MAKE SURE YOU’RE ON THE RIGHT PATH

Setting goals without tracking the results and your overall progress is a waste of time.

Financial goals will constantly evolve. You must regularly revisit your goals, make any needed course corrections, and set new goals if necessary.

Touching base with your goals on a quarterly basis will probably be sufficient. You may revisit and examine your priorities once a year. Both of these activities can be completed alongside a financial advisor.

Your long-term goals are hugely important. You should also enjoy each day in the present. With time, you can find the balance between enjoying the present and staying focused on the future. It isn’t easy, but this ability naturally grows/expands with time.

___________________________________

TL;DR

Creating financial goals is an important component of life. Money is a piece of the goal, not the end goal. The key is to leverage it in a way that enables you to live the life you want.

To do this, you must understand the data behind your current situation then align any financial goals with your priorities/long-term desires.

When your finances and priorities are tied together, you can more easily reach balance/peace and find purpose.

___________________________________

What financial goals are you setting for the new year? What do you hope to accomplish throughout this year and the rest of your life?

If this post resonates with you and could be useful to someone you know, share it with them and tell them to subscribe!